BEC Targets Renters, Deadline ID Scam, UK Mobile Scams

Hello there! Hope you are doing well and are able to safeguard your data and mental peace against cybercrooks.

This is the first week of May, and we’re back once again with our fresh dose of cyber news. With every bulletin we bring to you, we aim to empower you with cyber education, so you stay prepared to combat the cyber menace everywhere.

This week, we are going to talk about the BEC scammers who are targeting Canada and France-based property renters. Next, we will focus on cybercrooks who are sending malicious emails to REAL ID seekers in Arlington. Lastly, we will talk about the sudden rise in mobile scams across the UK.

Let’s not waste any time and get started!

BEC scam campaign designed to target property renters!

If you are a French property renter, you must see this!

Cybercrooks are sending out fake emails to property renters across France to make quick money. Threat actors are using compromised mailboxes of educational institutions to impersonate prominent rental property management firms and deceive unsuspecting property renters. These fake emails are sent with the ultimate goal of convincing unaware property renters to pay their monthly rent to a new bank account controlled by the threat actors. When making a payment or authorizing their bank for monthly auto payments, users are required to share proof of action with a free Outlook or Gmail account.

To safeguard against phishing and BEC scams, implementing SPF, DKIM, and DMARC records can enhance email authentication and protect your communication from being spoofed by cybercriminals.

According to the FBI’s recent digital crime report, BEC scams have resulted in substantial losses, totaling $2.8 billion in 2024. However, this ongoing campaign appears less damaging when assessed financially. The threat actors impersonate French real estate management firms with the help of AI. The unusual phrases and vocabulary used in the fake emails make it highly likely that the attackers themselves are not native French speakers.

Experts advise property renters to carefully assess each email they receive before taking any action. They should read between the lines and be extra cautious when money is involved or a sense of urgency is present. Additionally, paying close attention to minor spelling mistakes or any irregularities in the content can be quite helpful.

Scammers targeting those who are waiting till the deadline to get REAL IDs!

If you are waiting till the deadline to get your REAL IDs, be aware of cybercrooks as they are targeting you by leveraging your sense of urgency. In Arlington, residents have just seven days from today to obtain their government-issued ID cards. Meanwhile, the threat actors are misusing this race against time. They cleverly pose as government agencies (DMV) and fool people into sharing their private data or even compel them to click on malicious links.

Experts recommend being extra careful during the entire process and interacting with genuine government agencies only. Also, being cautious while going through emails is totally advisable. Another thing to keep in mind is to verify whether or not the websites carry “.gov” extensions. Reading the email content to detect spelling mistakes and extra characters can also be super helpful.

Most of the time, these suspicious emails will ask you to “verify compliance” or “update your information.” They may also portray a sense of urgency. If you are not sure about the authenticity of the email or have the slightest doubts, then it is better to visit the DMV website for further course of action.

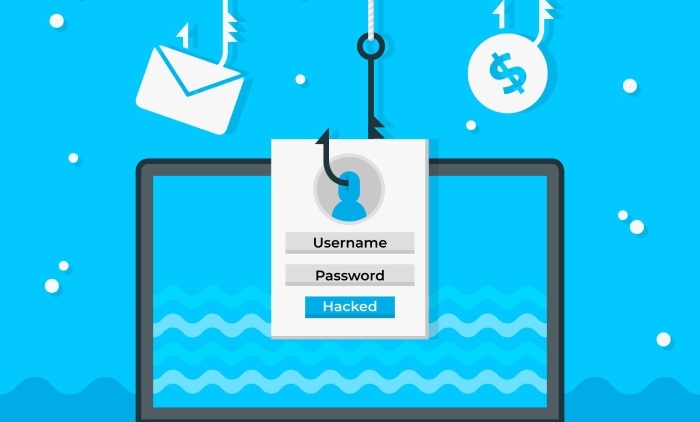

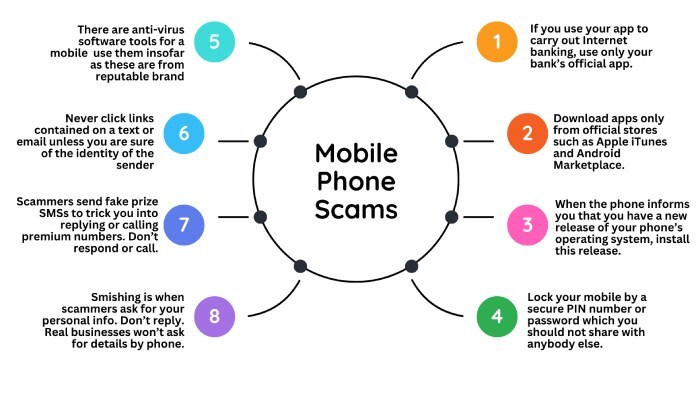

UK mobile scams on the rise in 2025!

Mobile scams are on the rise across the UK in 2025. The top fraud prevention service providers in the UK have joined hands to educate mobile users against potential mobile scams. The cybercrooks are a part of internationally operated organized crime groups. They impersonate leading retailers and brands and send malicious SMS messages to users. The messages are often designed to offer “help.” For example, the messages can be about reducing your utility bills, or an easy application for a living allowance, and so on.

When a naive user clicks on a malicious link, they are instructed to share their card details. The moment you share the details, you will receive an OTP through SMS. The moment you share this OTP, the threat actors can gain access to your bank accounts.

If you or your loved ones receive any such suspicious SMS messages, do not click on any link. Forward the SMS to 7726. Also, get in touch with your bank account and inform them about this SMS. Reporting the incident to Action Fraud (0300 1232040) would be the most ideal thing to do in this case.

Users should be wary of any “too good to be true” offers on SMS. Also, going through every SMS cautiously can prevent such mobile scams easily.